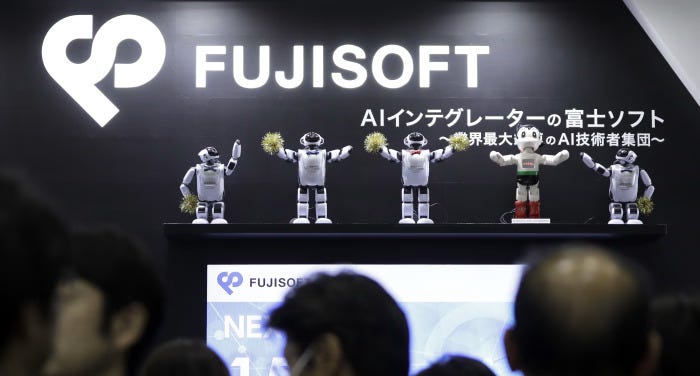

KKR to acquire 100% of FUJI SOFT through full buyout backed by founding family

KKR is set to acquire 100% of FUJI SOFT in a full buyout deal backed by the founding family, marking the complete privatisation of the Tokyo-listed software firm.

Through FK Co., an entity owned by KKR-managed investment funds, the global investment firm has signed a Memorandum of Understanding with the founding family of FUJI SOFT to support the transaction.

The deal follows KKR’s earlier stake acquisitions via two tender offers.

The proposed buyout includes a share consolidation that will result in FK and NFC Corporation becoming the sole shareholders of the company. This “Squeeze-out” process will be put to a vote at an Extraordinary General Meeting of Shareholders scheduled for 25 April 2025.

Following the Squeeze-out, FUJI SOFT plans to repurchase shares held by NFC. This step, expected after early June 2025, will result in FK acquiring 100% ownership of the company.

The move underscores KKR’s ongoing interest in Japan’s technology sector and its strategy of taking public companies private to drive operational transformation.